If you are required to file a Self-Assessment then these are some of the records and information that you will need to supply to your accountant ahead of the filing deadline:-

Employment Income – If you were employed at any point during the tax year you need to supply copies of any P60’s and/or P45’s. You will also need to provide a copy of your P11D for any benefits in kind you may have received during the year.

Self-Employment Income – This would include income and allowable business expenses.

Pension Income – Both State and Private Pension income will need to be declared. Private Pension companies will send out a P60 which should be forwarded to your accountant.

Investment Income – Such as interest on bank or savings accounts (excluding ISA’s).

Dividends received during the year.

Rental Income – Details of rental income and allowable expenses. You can get tax relief on mortgage interest on buy-to-let properties so should ensure you include these details.

Capital Gains on any assets disposed of during the year.

Personal Pension Contributions – Give details of contributions to personal pension schemes as these give additional tax relief if you qualify.

Gift Aid Donations – As with personal pension contributions, these can offer additional tax relief.

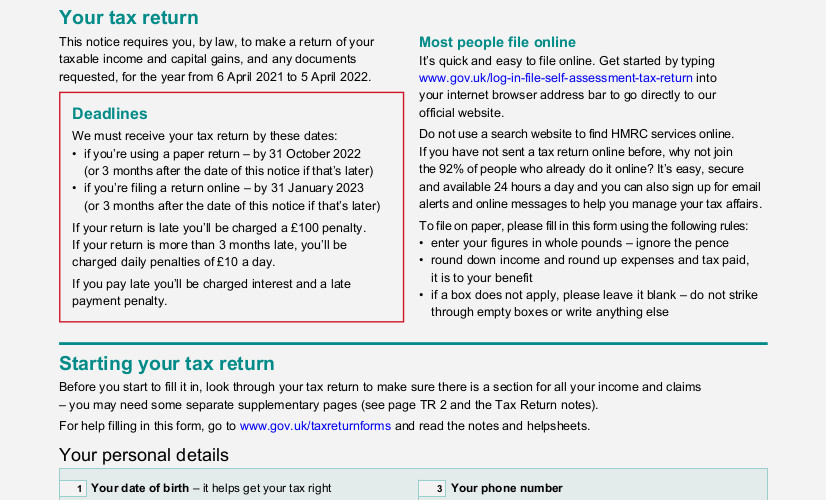

These are some of the most common items to include in your Self-Assessment but by no means everything. If in doubt you should check with your accountant. It is often a good idea to get your information ready well ahead of the filing deadline so as to avoid the possibility of filing your Return late and incurring any penalties or fines.

If you need help preparing and filing your Self-Assessment please get in touch.