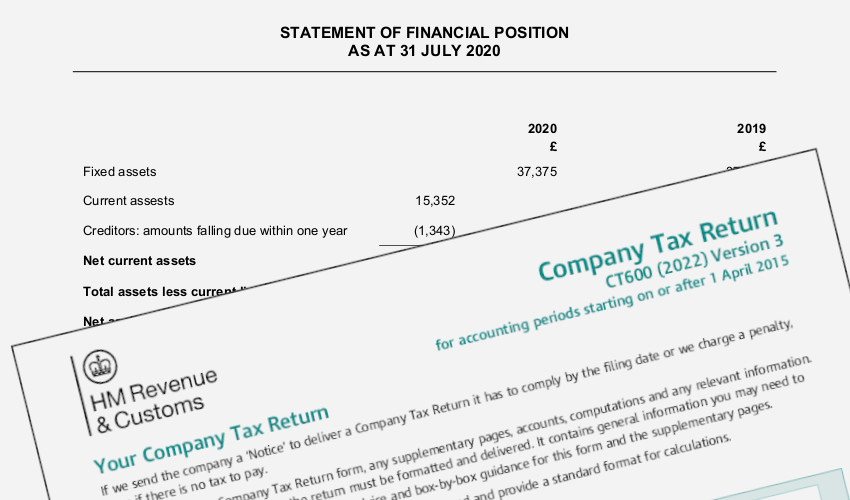

If you operate a Limited Company you will be required to file Annual Company Accounts with Companies House and Corporation Tax Returns with HMRC. In order for your accountant to prepare these for you, you will need to supply the following information:-

Bank Statements for the period your accounts cover. This would be for all the accounts in the company’s name including current accounts, deposit/savings accounts, PayPal, etc. This will ensure no transactions are missed and that the balances are correct at the year end.

Business Credit Card Statements – Again, any credit card statements in the company’s name.

Loan Statements – To ensure the closing balances are correct and any interest is accounted for.

Finance Agreements – Copies of any new agreements taken out during the accounting period.

Creditors and Debtors – Details of any creditors and/or debtors at the year end.

Sales Invoices – All sales invoices raised during the year, including any that are still outstanding Also, any credit notes as well as details of any income where you did not raise an invoice.

Purchase Invoices and Receipts – This should ensure no expenses are missed and, as with sales invoices, it could be that some purchase invoices have yet to be paid at the year end.

Petty Cash Receipts – Your accountant will need to reconcile your petty cash receipts against your cash to ensure the closing balance is correct.

Payroll Records – If your accountant doesn’t operate your payroll for you they will need these details so that they can ensure all wages, Tax and National Insurance are included in your accounts.

Stock/Inventory Value – A valuation of any stock or inventory at the year end. The lower of cost and net realisable value should be used.

Above are a number of common items needed by your accountant but there could well be others and if in doubt you should check with your accountant first. It is always a good idea to get this information ready well ahead of the filing deadline to ensure your Accounts and Corporation Tax Return are prepared in good time and you do not miss any filing deadlines, which could incur penalties or fines.

If you use online accounting software, such as Xero, Quickbooks, FreeAgent, etc, this can help reduce the number of items you will need to send to your accountant as bank transactions, sales invoices, purchase invoices and receipts, etc, can be uploaded to these systems and the bookkeeping completed ahead of time.

If you need help preparing and filing your Limited Company Accounts and Corporation Tax Return please get in touch.