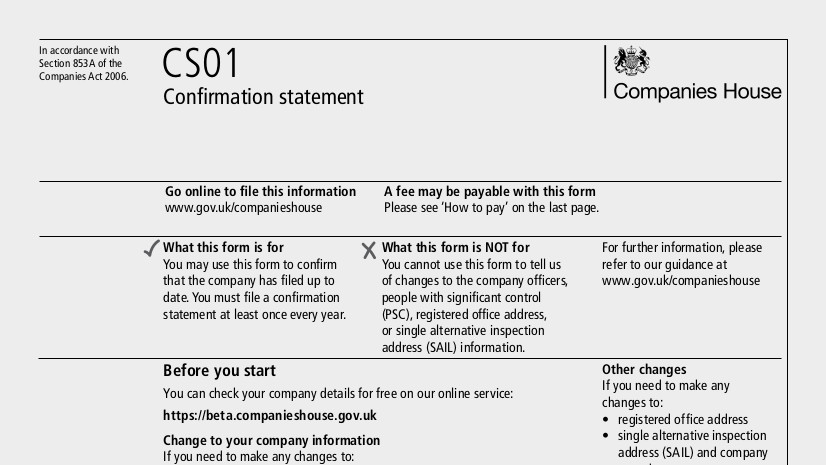

On 30 June 2016 The Annual Return was replaced by The Confirmation Statement. Every company must file a confirmation statement with Companies House at least once every twelve months, even if the business is dormant. The purpose of the Confirmation Statement is to confirm that your company information held by Companies House, and displayed on the public registrar, is up to date.

To complete the confirmation statement, companies are required to check the information held at Companies House and confirm it is correct. The information you will need to check includes the following:-

- Registered office address. Officers – Information about each director and each company secretary (if applicable).

- Registers – Single alternative inspection location (SAIL address).

- Standard Industrial Classification (SIC) – This code identifies the business activities of your company.

- Share capital:

- Total number of shares issued

- Total aggregate value of shares issued

- Total aggregate amount unpaid

- The prescribed particulars of the rights attached to each class of shares

- Total number of shares of each class

- Aggregate nominal value of shares of each class

- Shareholders – The name of each shareholder and the number of shares, and class, held.

- People with significant control (PSCs) – The name and date of birth of all PSCs.

You must file a confirmation statement even if there have been no changes to the company’s details and they are exactly the same as when the company was incorporated or the last confirmation statement was filed. If the company details have changed, you can report changes to the share capital, shareholder information, and SIC codes at the same time as filing your confirmation statement. Other details must be updated separately using the appropriate Companies House forms.

As mentioned above, you must file a confirmation statement at least once every twelve months. You should receive a reminder from Companies House, by either email or letter, of the date when your confirmation statement is due. You have fourteen days from this date within which to file your confirmation statement.

Failure to file your confirmation statement is a criminal offence and can lead to serious consequences. You can be fined up to £5,000 and your company may be struck off if you do not send your confirmation statement.

You can file your confirmation statement online or by post and it costs £13 online and £40 by post. If you are not comfortable filing this yourself it is something we can do for you so please contact us for help or assistance with this process.